Why Limit AI Works for Me

As Head of Brokerage at Limit, I've observed a clear shift in the insurance industry towards technology-driven solutions. Increasingly, competitors are leveraging technology to streamline their operations, making speed and thoroughness essential for brokers today. While I have always been able to balance both, I had a hunch that with the right tools, I could operate a lot faster

The turning point came during a particularly hectic period. A surge in emails, coupled with the need for quick policy reviews and market updates, left me stretched thin. I couldn't afford to compromise on quality, but I needed to find a way to work more efficiently. That's when I turned to Limit AI - at the time an experimental tool enabling the team to leverage artificial intelligence.

My approach with Limit AI was to integrate it into my routine gradually, starting with tasks that were more administrative than advisory. I started by using the AI to draft basic emails. To my surprise, the AI not only produced high-quality drafts but also saved me considerable time.

Encouraged by this small success, I moved on to using Limit AI for comparing quotes. I quickly realized that it could rapidly process vast amounts of data, highlighting differences in quotes and policy language that I might have missed in a manual review. Limit AI could sift through hundreds of quotes, pinpoint the most competitive ones, and present them in a clear, organized manner. This didn’t eliminate my role in the process; rather, it enhanced it. I was now able to focus on the nuances that required a human touch—understanding the client’s specific needs and advising on the best options—while the AI handled the heavy lifting of data analysis.

The next step was incorporating Limit AI into policy reviews. This was a task that had always required a meticulous approach, as overlooking a single detail could have significant consequences. Initially, I was skeptical that AI could handle the complexity of policy documents. However, I soon found that Limit AI was exceptionally adept at identifying inconsistencies, potential risks, and areas that required further attention. It could cross-reference different sections of a policy, flagging any contradictions or unclear clauses. This capability proved invaluable, not only saving me time but also adding a layer of precision to my work that was previously difficult to achieve.

Limit AI was especially important one Friday afternoon when a client approached with a request that I turnover a complex cyber quote proposal in mere hours. Without missing a beat I uploaded their quotes to Limit AI and within minutes I had a freshly formatted proposal document in hand, complete with all of the coverage comparisons, summaries, and key term definitions needed to seal the deal.

In another tough moment, a program I spent a month developing threw a curve ball and a retailer needed me to generate COIs for over 75 insureds in a single day. Once again, Limit AI saved the day by generating the forms for me at a click of a button

Looking back, I realize that my initial reluctance to embrace AI was rooted in a fear of the unknown—a fear that is common in any industry facing technological disruption. However, my experience has shown that AI is not something to be feared but rather a tool to be harnessed. In the context of commercial insurance, where precision, efficiency, and client satisfaction are paramount, Limit AI has proven to be an invaluable asset. It has allowed me to maintain the high standards of service that my clients expect while also freeing up time to focus on the aspects of the job that truly require a human touch.

AI transitions require time and focus. If you want to learn more about how I approached the transition, feel free to shoot me an email to jesssica@limit.com (this is actually my email). I’m excited to hear from you!

Limit AI is here to revolutionize your workflow.

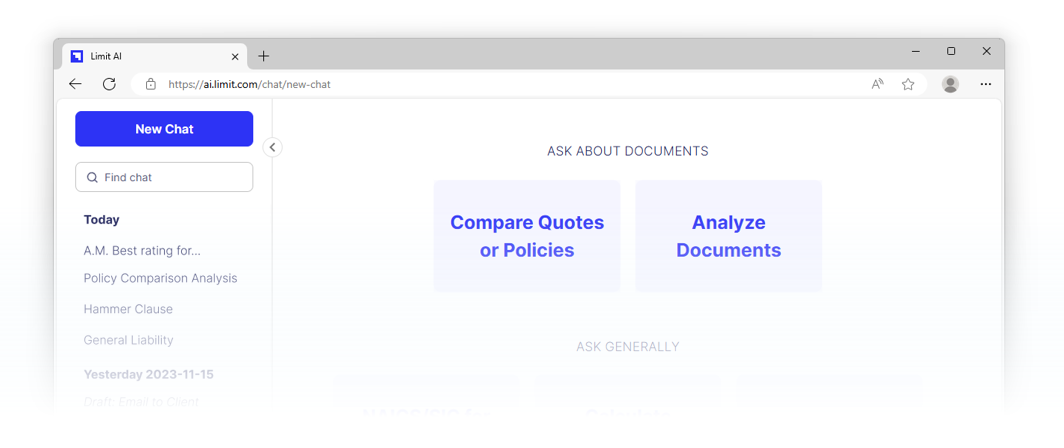

Limit has built the State of the Art AI for insurance. Limit AI will summarize and compare your quotes, run your surplus lines taxes and fee calculations, identify coverage deficiencies, and do what you need to get your job done. Limit AI is extremely well-versed in all lines of P&C and highly skilled at analyzing your policies & quotes.

Our AI Assistant is built on Limit’s years of expertise as a commercial insurance wholesaler with hands on experience in all lines of P&C. Limit AI answers questions, drafts emails, and compares quotes & policies with substantially more rigor and attention to nuance than any other competitive AI product today.

Ready to get started? Join the waitlist by visiting limit.com/ai or email us at contact@limit.com.