Why Now is the Time to Buy Cyber Insurance.

Now is an opportune moment for your clients to purchase cyber insurance, especially in light of several recent developments that have highlighted both the urgency and availability of coverage at competitive rates.

In September 2024, Delinea reported that 62% of businesses had filed cyber insurance claims over the past 12 months, underlining how prevalent cyber threats have become. This increase in claims is largely driven by ransomware and business email compromise (BEC) attacks, which continue to dominate the threat landscape (Insurance Journal). Ransomware attacks surged by 18% in the first half of 2024 compared to the previous year, with attackers employing increasingly sophisticated methods such as double and triple extortion. This has been exemplified by numerous high-profile breaches, including the July 2024 global IT outage, which severely disrupted businesses across various sectors, underscoring the need for cyber insurance to cover operational and reputational risks (Howden Group).

The rise of Generative AI (Gen AI) is also making cyber attacks more accessible to less skilled hackers, drastically increasing the frequency and complexity of attacks. AI-driven phishing scams and tailored ransomware are becoming commonplace. For instance, AI-enabled business email compromise scams have surged, and with more sophisticated techniques, attackers can easily deceive employees into transferring money or sharing sensitive information. These trends highlight the need for businesses to have comprehensive insurance policies that cover these emerging risks (Astra Security).

Moreover, despite this heightened threat environment, the cyber insurance market is currently offering favorable conditions for buyers. Cyber insurance premiums, which skyrocketed in previous years, have begun to stabilize and, in some cases, decrease. A Howden report from late 2024 noted that improved cybersecurity measures, such as multi factor authentication (MFA) and cloud backups, have reduced claims, leading insurers to offer more competitive pricing (Howden Group). For example, businesses that have invested in stronger cyber defenses are now securing policies with double-digit price reductions. This is an ideal time for companies to lock in coverage at favorable rates before premiums rise again as threats continue to evolve (Insurance Journal).

Furthermore, geopolitical instability, such as the ongoing war in Ukraine and state-sponsored cyberattacks, is fueling the frequency of politically motivated cyber incidents. Nearly 90% of attacks from April 2023 to March 2024 were politically driven. This reinforces the need for businesses, especially those with international operations, to secure cyber insurance as a defense against increasingly complex threats (Howden Group).

In summary, with the rise of AI-powered cyber threats, the persistence of ransomware, and the volatility of the geopolitical environment, now is the perfect time for businesses to invest in cyber insurance. The market’s favorable conditions, coupled with an ever-growing need for protection, make it critical for your clients to act now to secure comprehensive coverage before further developments make this essential protection more costly.

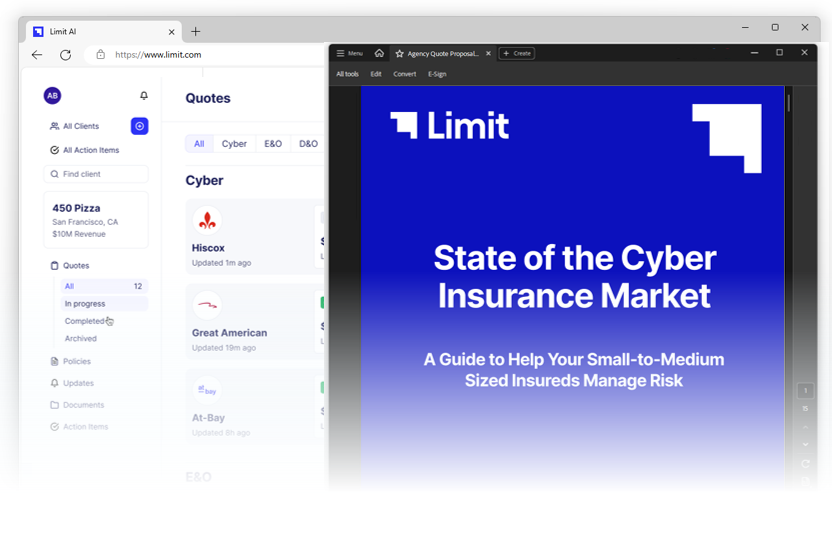

Limit AI is here to revolutionize your workflow.

Limit has built the State of the Art AI for insurance. Limit AI will summarize and compare your quotes, run your surplus lines taxes and fee calculations, identify coverage deficiencies, and do what you need to get your job done. Limit AI is extremely well-versed in all lines of P&C and highly skilled at analyzing your policies & quotes.

Our AI Assistant is built on Limit’s years of expertise as a commercial insurance wholesaler with hands on experience in all lines of P&C. Limit AI answers questions, drafts emails, and compares quotes & policies with substantially more rigor and attention to nuance than any other competitive AI product today.

Ready to get started? Join the waitlist by visiting limit.com/ai or email us at contact@limit.com.